We have been getting questions about estimated tax payments and when those should be paid.

First let me explain the purpose for estimated tax payments and how they should be calculated. Estimates are used to pay your taxes in evenly throughout the year if you do not have income that has federal or state taxes withheld.

For the purpose of this post we will discuss federal only. The payments are used to avoid penalties. If you pay taxes late you can incur interest and penalties from the time it should have been paid until it is paid. You are subject to penalty if you do not have 90 percent of the current year tax paid in, 100 percent of the prior year taxes paid in, or 110 percent of the prior year tax if your adjusted gross income is $150,000 for married filing joint or $75,000 if single.

We help our clients annually with calculating these estimates. We start with basing them off of the prior year income, then as the client knows more about the income for the current year we adjust as needed.

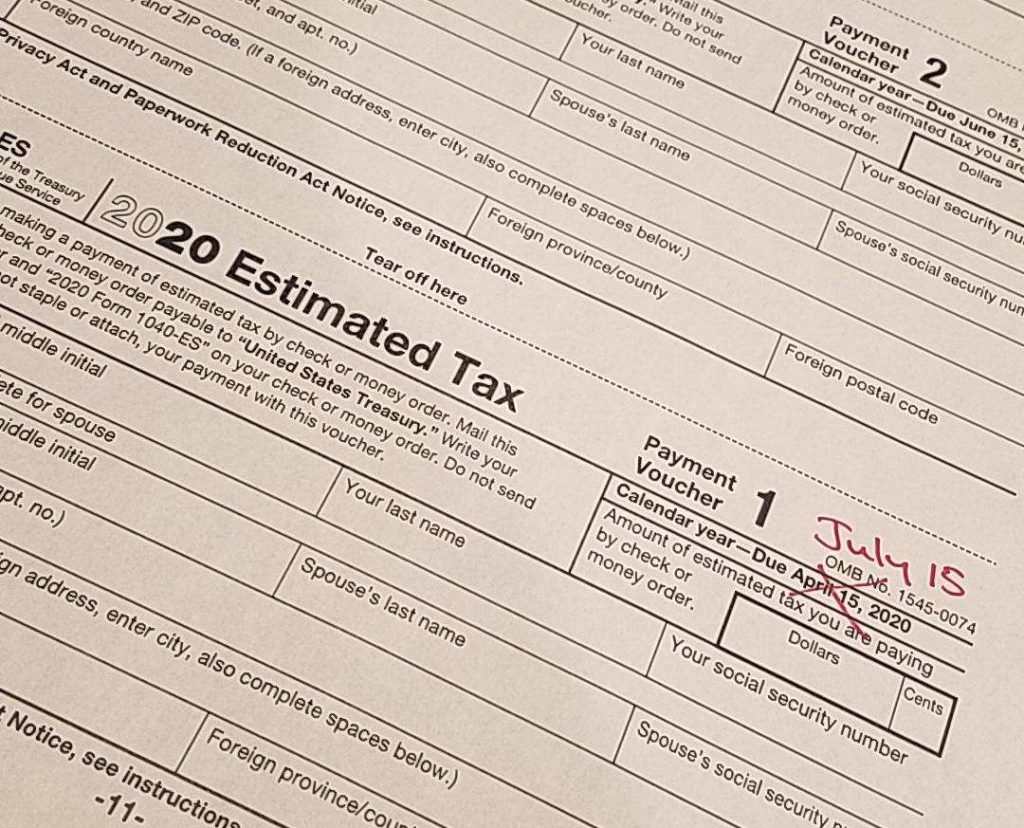

Next lets talk due dates; the due dates are typically April 15, June 15, September 15, and January 15. This year is an exception with the delays in tax filings, so the first quarter estimate is now due July 15 instead of April 15.

To keep up to date on these due dates you can visit https://www.irs.gov/faqs/estimated-tax/individuals/individuals-2

The Wassman CPA Services website and blog is meant to offer general information to our readers. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service. You should contact Wassman CPA Services for advice concerning specific matters prior to making any decisions.