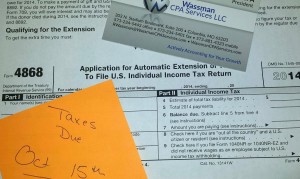

The extended tax deadline for individuals is quickly approaching. The deadline is October 15. I thought this would be a good time to remind you (if you have not filed yet) items that you will need in order to have your tax return prepared.

I typically run into clients missing the easy items at this point. Some of my clients get so involved in working to get their business or rental information together that they forget to include all or part of the tax forms they were sent in January. These items include W-2s, 1099s for investment income or other income, 1098s for mortgage interest or student loan interest. Also you will want to make sure if you are able to deduct medical you include that information as well as any charitable contributions.

I typically run into clients missing the easy items at this point. Some of my clients get so involved in working to get their business or rental information together that they forget to include all or part of the tax forms they were sent in January. These items include W-2s, 1099s for investment income or other income, 1098s for mortgage interest or student loan interest. Also you will want to make sure if you are able to deduct medical you include that information as well as any charitable contributions.

While gathering all of your business income and expense, include your home office expenses. In order to qualify for a home office deduction the space needs to be used solely for business, no personal use. If you have a space like this you will want to include information to explain the space used. The easiest is to use the square foot of the office space and the square foot of you total home. For deductions include, rent or mortgage interest and property taxes, utilities, insurance, and repairs.

Since this is the last rush for tax preparation if you make sure to have all documents needed when you meet with your preparer, it will make it easier for the preparer to insure you get your return filed timely and avoid late filing penalties.

The Wassman CPA Services website and blog is meant to offer general information to our readers. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service. You should contact Wassman CPA Services for advice concerning specific matters prior to making any decisions.