A few weeks ago I was given a set of instructions for filing the individual income tax return form 1040 from the tax year of 1943. I found reading the instructions very interesting compared to how  we file returns today.

we file returns today.

The part I found most fascinating is that in 1943 the instructions were only four pages — yes, only four pages — now they are more 100 pages. This represents how much more complex our tax laws have become in the past 70 years.

The instructions touched on several items that are still in effect today, but also some of our history when discussing a victory tax and deductions for loss of personal property from shipwreck or for property that was destroyed or seized in the course of military or naval operations during the war.

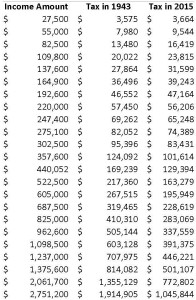

I also looked at the tax brackets and rates, which was the biggest change because at that time there was an 82% tax rate. After reading that I decided to look at the tax rates today compared to 1943 and estimate some taxes based on different levels of income. See the chart for how they compare.

The Wassman CPA Services website and blog is meant to offer general information to our readers. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service. You should contact Wassman CPA Services for advice concerning specific matters prior to making any decisions.