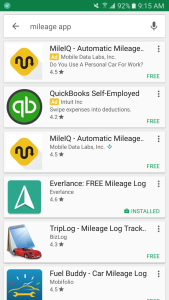

Tracking mileage can be an incredibly tedious task and can often result in missed deductions and unnecessary paper waste. Thankfully, there’s an app for that!

The 2017 mileage rate is $0.535/mile, so every 1,000 miles is worth $535.00 as a business expense, so mileage tracking can be crucial. We have research a few app. available on both iOS and Android, which can be used to make your life easier.

| Mile IQ | MileBug | TripLog | Everlance | Trip Tagger | |

| Features: | |||||

| Automatic Tracking | Yes | No | No | Yes | Yes |

| Cost | Free up to 40 Drives, $5.99/month unlimited | $2.99 Total Cost for Unlimited Drives | $2.50/month | $7.99/month for Everlance Premium | Free |

| Categorize as personal or business | Yes | Yes | Yes | Yes | Yes |

| Printable Reports | Yes | No | No, but has email option | Yes | No |

| Mileage Logs by day, week, or month | Yes | Yes | Yes | Yes | Yes |

| Multiple Vehicles | No | Yes | Yes | Yes | No |

The costs of some of these apps may look high, but the potential deductions that could result from using them would far outweigh the costs, especially if you’re on the go constantly.

In addition the cost of the app would be deductible. The key points to look for is that you can get a printout of your miles for your tax records.

The second item to watch for is that you aren’t limited on the number of trips.

Then of course you want to look at the cost. Keep in mind as with most apps some work better on iOS and other better on Android. The apps we looked at have a free trial period so I’m recommending for my clients that are interested download a few and try them to see which works best for your needs.

The Wassman CPA Services website and blog is meant to offer general information to our readers. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service. You should contact Wassman CPA Services for advice concerning specific matters prior to making any decisions.